Against the backdrop of the post-pandemic recovery, consumers across the Asia Pacific region have been adapting to many challenges: inflation, a cost-of-living crisis, and supply-chain-related instability of product availability, to name a few.

The pandemic has disrupted traditional in-store shopping patterns for three long years, but a recent return to a more ‘normal’ shopping environment has put into focus how much consumers driven online over that time would return to stores.

Amid the current saturated e-commerce landscape, as well as the current climate of economic uncertainty, there is therefore an even greater need for retailers to know how to better engage consumers to gain market share, particularly as consumers recalibrate their spending.

KPMG and GS1’s latest research of 7,000 consumers across 14 markets in the region reflects multiple patterns and expectations among consumer groups, but one over-riding conclusion is clear: The era of seamless commerce has arrived and while both online and offline channels remain popular throughout the region, traditional retail business models are unlikely to meet the expectations of many consumers today. Retailers and brands will have to adapt or face potential consequences of not moving with the market.

From omnichannel to seamless retail

We’re witnessing a third wave of digital disruption in the ever-evolving retail landscape. Previously, multichannel approaches—such as online and brick-and-mortar stores—operated independently within the same retail umbrella. However, the omnichannel era, fuelled by data analytics and AI, has prompted retailers to build bridges across these silos, encouraging collaboration.

Now, with seamless commerce, we’re entering a new evolutionary phase. The seamless commerce approach recognises that consumer interactions span multiple channels, blurring the lines between online and offline. To deliver a truly seamless experience, retailers must adopt an end-to-end perspective, making decisions through a fundamentally different lens. If they don’t deliver a truly seamless experience and don’t adapt their businesses to meet the expectations of the next generation of consumers, they will struggle to survive.

Innovative retailers are striving towards seamless commerce – which recognises a brand’s customer journey across multiple platforms and services, encompassing social media, delivery innovations, apps, websites, automated messaging, and other digital interactions, all seamlessly integrated within traditional physical stores.

The concept of seamless retail was fuelled by the pandemic, where consumers across all generations were driven to shop online, unable to visit physical stores due to movement restrictions. Not only did they head online to purchase food, groceries, and other essential goods, but the migration from working in offices to working from home saw demand in categories such as apparel and home furnishing.

With this shift, seamless commerce – once a differentiator – is now a baseline expectation from consumers; retailers and brands will have to adapt or face potential consequences of not moving with the market.

It’s never a one-size-fits-all in Asia-Pacific

In recent decades, the Asia-Pacific region has been at the forefront of retail transformation, notably in its early and extensive adoption of online platforms which have played a much larger role compared to the rest of the world.

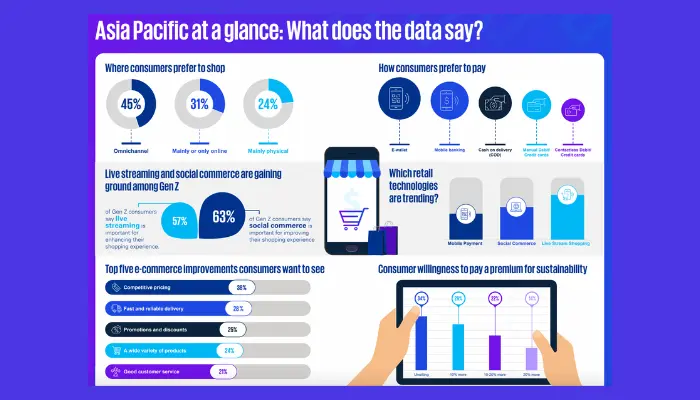

Although COVID has accelerated online shopping across the region, results tell us that consumer habits in terms of how, where, and when they shop remain highly varied. On average, 45% of respondents preferred the ‘omnichannel’ approach, while in a boost for physical-first retailers, relatively few respondents said they could live with only shopping online.

In fact, the e-commerce landscape in the region is marked by a lack of a dominant platform – although various solutions and marketplaces are prevalent in individual markets. There is intense competition among platforms to capture the consumer’s dollar, and these figures identify a wide variety of products and fast, reliable delivery as two of the top three priorities for consumers when choosing a platform.

In terms of desired improvements, competitive pricing ranked as the foremost expectation in Asia-Pacific, cited by 38% of respondents, while promotions and discounts ranked third at 25%, highlighting the need for retailers to implement price strategies that ensure they remain competitive in the market.

Despite these aggregated results, the study reveals that although online is now more important than ever as a retail shopping channel, others such as livestreaming and social shopping are growing at differing rates in many locations. Marketplaces, once at the vanguard of retail transformation, are now coming under attack from new players, including department stores and other multi-brand retailers developing sophisticated, personalised platforms to recover market share they may have lost online.

More notably, a one-size-fits-all retail strategy – if ever it made sense – is becoming less and less meaningful.

How AI is shaping customer experiences and driving sales

With consumer preferences in Asia-Pacific being ever-varied, retailers are embracing AI at an unprecedented speed, resulting in improved customer experiences and increased sales.

In fact, our interviews with senior executives suggest that the adoption of AI by retail enterprises is faster than any previous technology – both at customer-facing points and behind the scenes. Analysis from Stocklytics predicts the generative AI market will hit US$1 trillion in value by 2031, representing a cumulative annual growth rate of 48.05%.

Front-of-house, AI is being used to refine customer experiences in automated chat platforms by developing a better understanding of consumer experiences and behaviour to provide more accurate responses and information.

Responses to customer enquiries can be based on relevant help centre content – directly provided within the conversation, rather than just sharing relevant FAQ responses as is typically done.

Back-of-house, AI has become an indispensable tool in functions such as demand forecasting, supply chain management, and developing marketing content. We have seen how ChatGPT has taken the world by storm, with a user base of more than 180 million people in November 2023.

There is a huge opportunity for AI to help companies understand purchasing trends – sudden spikes or drops in volume, for example – to maintain optimum inventory levels. It can contribute to significant efficiencies in sourcing, shipping, and inventory optimisation by predicting product demand, thereby mitigating issues like out-of-stock inventory or overordering. Currently, such decision-making processes may be delayed or predominantly manual, but the leverage and scalability that AI brings can greatly amplify the output traditionally managed solely by human personnel.

Incorporating seamless commerce strategies for sustainable business growth

Across Asia-Pacific, retailers who limit themselves to one channel face significant risks. Online-only retailers may lack the personal touch and might encounter difficulties in establishing reliable delivery systems, while traditional brick-and-mortar stores are not only missing out on reaching a broader audience but also on leveraging their physical presence for innovative solutions like ‘click and collect’ services or using their locations as local distribution hubs.

To meaningfully address these dynamics, focusing on a frictionless customer experience as the ultimate benchmark for measuring success is crucial. Insight-driven retailers need to utilise data and analytics to predict, strategise, and tailor their product offerings and service delivery, backed by a deeper understanding of their customers’ needs.

Technologies such as AI and Gen AI are increasingly helping retailers to yield actionable insights and interventions that improve customer experiences – from enhanced demand forecasting and customer service to optimising product availability and fine-tuning pricing and promotions.

Indeed, a seamless online-offline customer experience has now become a baseline expectation. Only by excelling in this domain can retailers expect to lead the market.

This thought leadership is written by Anson Bailey, Head of Consumer & Retail, for KPMG in Asia Pacific

MARKETECH APAC is leading the conversation on the future of e-commerce marketing strategies this 2024 and beyond with the E-Commerce Marketing in Malaysia 2024 conference on July 25, 2024 at Sheraton Petaling Jaya and the E-Commerce Marketing in the Philippines 2024 conference on August 14, 2024 at Crowne Plaza Manila Galleria. Join us and become an integral part of a dynamic community committed to pushing the boundaries of innovation and fostering unparalleled growth in the e-commerce domain.

لا تعليق