The fashion and apparel industries have proved time and again this century the immense power fashion brands hold in the ecommerce space. Many juggernaut brands include FashionNova, SKIMS, and other powerhouse DTC brands SHEIN, Chewy, and Gymshark. Yet there are factors in the fashion ecommerce world—things like digital innovation, rising globalization, sustainable practices, and changes in consumer spending habits—that have impacted the fashion industry writ large during the midst of such seismic shifts.

In this article, we’ll dig into those shifts by sharing the statistics, trends, and strategies that are shaping the ecommerce fashion market in 2024 and beyond, giving you an updated look on where the industry is now and where it’s going.

Top fashion ecommerce trends for 2024

Here’s a quick look at the trends we’ll be diving into in more detail:

Embracing AI

Sustainability at the forefront

Personalizing the customer journey

The continuation of the metaverse

Social commerce and shoppable content

The rise of resale and secondhand shopping

Buy now, pay later

The transition back to brick-and-mortar

Expanding into repair services

The shift to wholesale

There’s a wealth of growth opportunities available for fashion and apparel retailers despite the huge shifts in consumer behavior, global trade, and “normal” day-to-day lives for millions around the world.

Let’s look at these latest ecommerce trends that you can work into your long-term fashion sales strategy:

1. Embracing AI

When it comes to generative AI and using technology for helping customers and designers alike, the fashion industry seems like a no-brainer for adoption. From virtual assistants that help customers try on clothes to chatbots and inventory management for brands, AI is becoming a valuable tool for fashion buyers and sellers.

According to McKinsey, generative AI may end up adding between $150 and $275 billion dollars to the fashion industry in the next five years. This same report also notes that, from a creative perspective, AI can help with the design stage, development, 3D imaging, and creating realistic looking models for campaigns.

AI seems to be an excellent fit for the customer experience when it comes to the fashion industry. By providing what appears to be a personal shopper to customers, brands are able to ensure potential buyers are taken care of from start to finish in the customer journey, giving offers and personalizations along the way to make the most out of the experience.

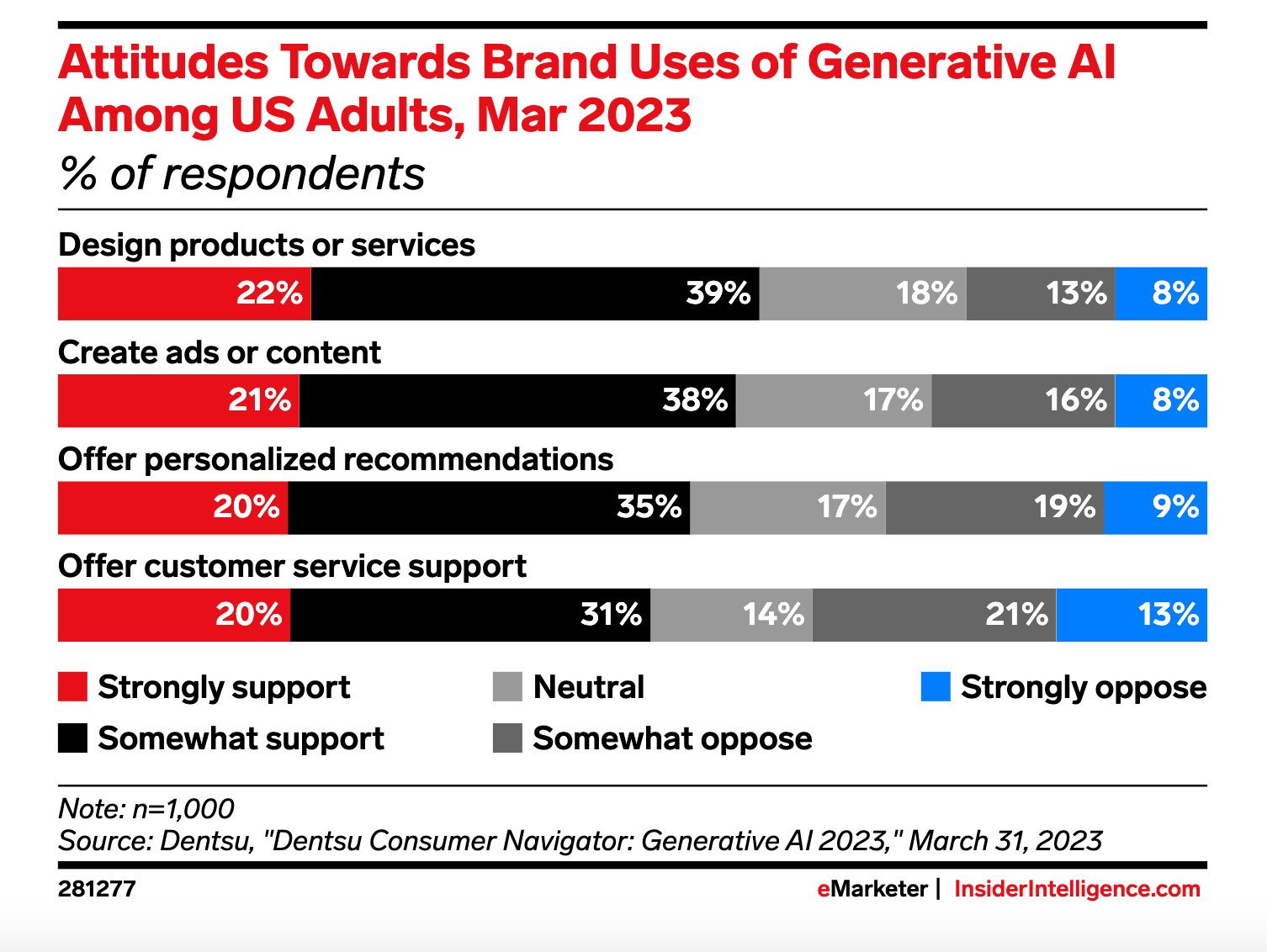

Source: Insider Intelligence. Attitudes toward brand uses of generative AI among US residents, 2023.

2. Sustainability at the forefront

The fashion industry is no stranger to criticism. Fast-fashion brands especially are chastised—sometimes rightly so—for the methods they use to manufacture and produce inventory.

In light of these criticisms making mainstream news, plus consumers’ increasing commitment to eradicate climate change, some 70% of shoppers say they are willing to pay more for sustainably produced goods.

Statista’s research shows 42% of global customers purchase eco-friendly and sustainable products. Certain countries are leading the trend—online shoppers in Vietnam, India, and the Philippines purchase sustainable products more often.

“With people spending more time online, it is going to facilitate faster exchange of that information [about suppliers]. We’ve become more aware of how things that happen in far flung places affect us and the planet. That’s been a real key change we’ve seen.”

—Grace Beverly, Founder, TALA

Purchasing habits are also shifting off the back of the pandemic. Some 55% of customers are interested in purchasing sustainable clothing, with the same amount of shoppers looking to brands to help them know what makes their clothes sustainable.

The fashion resale market is booming for this reason—growing 11 times faster than traditional retail and tipped to reach a $77 billion valuation in the next five years.

3. Personalizing the customer journey

Personalization has long been hailed as the secret of modern ecommerce. More than 70% of customers expect brands to tailor their shopping experiences and anticipate customer needs.

By showing items a shopper was previously interested in, or retargeting them based on the activity they’ve had with your ecommerce website, you’re providing a tailored online shopping experience—one that convinces them to buy.

That said, online shoppers are increasingly concerned about their privacy. Too much personalization can be creepy, hence why 8 out of 10 shoppers won’t share personal information with companies they don’t fully trust.

Culture Kings is the perfect example of how fashion ecommerce brands can balance personalizing not enough and too much. Instead of customizing the experience down to first-name tags on the website, they built four global storefronts to sell in different currencies. The result is that more than half of the fashion brand’s revenue now comes from their ecommerce business.

4. The continuation of the metaverse

The definition of metaverse is open to interpretation. And while the not-quite-defined promise of virtual societies is still in development, the idea is that people can conduct daily activities—like connecting with friends, playing a game, and purchasing products—by using augmented reality (AR) and virtual reality (VR) technology.

One type of item that functions both in and out of the metaverse is a non-fungible token (NFT). These NFTs are unique digital tokens that can only be owned by one person, usually paid for in virtual currency like crypto.

In reality, fitness apparel brands like Under Armour are experimenting with NFTs in the retail space. Its Steph Curry collaboration reproduced shoes the basketball star wore when he broke the NBA record as the all-time top three-point shooter.

Under Armour released digital NFTs alongside the physical product launch. Owners of the NFTs could virtually wear the shoes in three metaverses: Decentraland, The Sandbox, and Gala Games.

Retailer Forever 21 partnered with Roblox to create virtual fashion ecommerce stores in their metaverse, appropriately named the Forever 21 Shop City. Players run the virtual store as if it were their own, and they purchase merchandise for their avatar through the game.

Fashion brands are using Roblox to create immersive experiences for users and reach Gen Z audiences. This is just the beginning for fashion brands in the metaverse. As our world becomes more and more digitized, it’s likely that we’ll see even more brands experiment with NFTs and other virtual reality experiences. It’s an exciting time to be in the fashion industry, and can’t wait to see what brands come up with next.

5. Social commerce and shoppable content

Social media plays an integral role in the ecommerce marketing strategy of many online fashion brands. That’s hardly surprising—our daily lives are no longer complete without our smartphones. The typical social media user now spends about 151 minutes daily on social media, which—in an average lifespan of 73 years—is nearly 6 years of their life.

But the truth is, social media is no longer a place for shoppers to consume new fashion trends. Many social media platforms are evolving their business models to facilitate in-app shopping, helping online retailers reach customers actively in the purchasing frame of mind.

In fact, social commerce sales are expected to nearly triple by 2025, with 70% of Instagram users looking to the social media platform for their next purchase.

And when it comes to which types of content are working for fashion brands, it’s all about transparency. Some 66% of consumers watch videos to learn about a product or brand before they buy. Platforms like TikTok and Instagram are praised for driving sales for large fashion brands since shoppers can visualize the product on a real person. Bonus points if it’s a social media influencer they already trust.

Beyond influencer marketing on social media, multichannel ecommerce integrates native selling off site to build direct buying paths in the places your audience spends their time. Social media platforms are creating their own commerce features—like Shopping on Instagram, Facebook Shops, buyable pins on Pinterest, and more.

Livestream shopping is also in its heyday. Nordstrom launched their own livestream shopping channel last year—and it’s in good company. Online brands are seeing conversion rates of up to 30% through Facebook and Instagram livestreams, along with lower product return rates.

6. The rise of resale and secondhand shopping

Secondhand apparel is becoming a global phenomenon. The resale market grew 24% in 2022 alone, and is expected to reach a $218 billion market valuation by 2026.

Leading the trend are North American consumers, who have supercharged the region’s secondhand apparel market—propelling its growth eight times faster than the overall apparel market. Technology and online marketplaces are driving this trend, with 70% of consumers saying it’s easier now to shop secondhand than it was five years ago.

Maybe the most compelling stat? Secondhand displaced 1.4 billion new clothing purchases in 2022.

Fashion brands are taking notice. Dôen, a California-based premium fashion brand, is launching a resale program called Hand Me Dôen. The program will allow customers to send in preowned Dôen products in exchange for store credit.

Dôen will host flash sales throughout the year when the resold product becomes available. The goal of not making resale available all the time is to prevent customers from visiting the site and finding it already picked over.

SHEIN also launched a resale platform in the wake of criticism about their labor practices. Some experts are skeptical about the platform and believe it’s just a way for the company to greenwash their image. It remains to be seen whether fast fashion brands will be able to capitalize on the resale market in the same way luxury and premium brands have. Still, one thing is certain: the resale market is here to stay, and it’s only getting bigger.

7. Buy now, pay later

Once upon a time, we would place an item on layaway—a situation where we would put down a deposit on an item to pick it up at the store and pay the full amount.

Today, we use buy now, pay later (BNPL), which has that simple flexibility of layaway but scaled to fit the precise needs of today’s buyers. According to a report by Coherent Marketing, the BNPL market and platforms currently sits at nearly $11 billion in valuation, and it’s expected to reach more than $59 billion by 2030.

With a lot of new technology and ecommerce offerings, many assume millennials and Gen Z are the dominant demographics of BNPL’s success and forward momentum. Harvard Business Review proves that’s not entirely true with data showing Gen X are a driving demographic and Gen Z only a little ahead of boomers.

BNPL often allows customers to pay a set price without any interest. With credit card use on the decline, BNPL is an attractive purchase for those making big purchases without the extra cash to pay for it right away.

8. The transition back to brick-and-mortar

The shopping experience is more complex than ever—especially in the fashion space. Some 56% of online returns happen because the product ordered online doesn’t match the description. It’s this never-ending challenge that’s driving many fashion brands back into traditional retail.

Data compiled in our ecommerce trends report proves omnichannel commerce isn’t disappearing anytime soon. Modern consumers want both online and offline sales channels—and synergy between the two:

Half of Gen Z shoppers, who famously spend more time online than any other age group, favor in-store shopping.

59% of consumers say they’re likely to browse online and buy in store, and 54% are likely to look at a product in store and buy online.

Brands investing in brick-and-mortar retail include Canadian fashion brand SMYTHE, which opened their store in Toronto. After years of experimenting with pop-up shops, Gymshark also opened their first permanent flagship store in central London.

9. Expanding into repair services

Fixing items rather than throwing them away is becoming a trend for fashion brands. Bottega Veneta now offers all customers a lifetime warranty on their handbags. Louis Vuitton will also repair any bag for a price, depending on the item and type of repair.

The expansion into repair services comes at the helm of sustainability. The fashion industry is becoming more aware of its environmental impact, and repairs are a cost-effective way to keep clothes in good condition longer.

Brands like Patagonia and Arc’teryx have opened repair centers, as have fast fashion retailers like Zara and Uniqlo. Repair-focused startups have raised millions as interest in sustainable fashion and resale boosts demand to extend the life of garments.

10. The shift to wholesale

Inflation, supply chain issues, and lack of consumer spending is pushing DTC brands toward wholesale. A Glossy and Modern Retail survey showed that DTC brands are investing in other types of sales partnerships to diversify income.

When asked about performance over the past 12 months, 62% of respondents said wholesale revenue increased the most, even compared to direct sales. Brands see wholesale as a major business component moving forward too, with 80% predicting wholesale revenue will go up over the next year.

Digitally native brand in search of retail partnerships isn’t a new concept. Harry’s entered Target in 2016, and DTC brands like Quip and Native followed suit into big-box retailers shortly after.

But 2024 marks a turning point for DTC brands going into wholesale. Sales are up at mass retailers like Target and Walmart. Ongoing supply chain disruptions are making direct channel fulfillment increasingly harder, harming profits.

So while the pressure to grow may be intense, there are still opportunities for DTC fashion brands to find success. Wholesale partnerships may become essential for survival in coming years as DTC brands navigate the turbulent economic landscape.

Ecommerce fashion statistics

According to Statista, the ecommerce fashion industry’s compound annual growth rate (CAGR) is tipped to grow 14.2% between 2017 and 2025, with the industry hitting a $1 trillion valuation by 2024.

Sales of apparel, footwear, and accessories continue to rise, hitting $204.9 billion in the US alone. That’s tipped to grow by 13% this year, with consumers set to spend $204.9 billion on fashion items online.

Driving this growth are four notable opportunities:

Expanding global markets

Increasing online access and smartphone availability

Emerging worldwide middle classes with disposable income

Harnessing the power of celebrity and influencer culture

The biggest threats to established brands include:

The death of brand loyalty due to market saturation

Pressure from consumers to use ethically sourced and green manufacturing materials

Technological advancements with virtual worlds, such as

We’ll get into strategies to combat these issues later. For now, let’s examine how these big numbers play out in industry subverticals.

1. Clothing and apparel

Lower digital barriers to entry for all clothing merchants offer the opportunity to market, sell, and fulfill orders globally and automatically. As a result, worldwide revenue and revenue per user are both projected to grow.

Fashion ecommerce increased to $183 billion in the US alone, up nearly $3 billion in 2021. By 2027, the market outlook is expected to be over $300 billion.

2. Shoes

As a segment of ecommerce fashion, the shoe industry saw similar peaks in market value. In global market size, the footwear segment will increase from $365.5 billion in 2022 to $530.3 billion in 2027. The average US buyer spent nearly $600 in 2022 on footwear.

Asia is dominating this segment, holding 54% of the global footwear market, compared to just 14.8% for Europe and North America, respectively.

Athletic footwear is also a growing segment, tipped to generate $63.5 billion in 2023—a 23% increase from the $51.4 billion valuation in 2020.

3. Accessories and bags

The bags and accessories segment—although still growing at a stronger rate—will likewise see double-digit growth. The fashion accessory segment will have a CAGR of 12.3% between 2016 and 2026, with Asia-Pacific being the fastest-growing market.

Those projections actually make bags and accessories one of the healthiest segments of ecommerce fashion, despite its absolute numbers being the smallest.

4. Jewelry and luxury

In 2020, the global jewelry market was valued at a total of $228 billion. It’s forecasted to reach $307 billion by 2025, with ecommerce sites expected to facilitate 20.8% of sales in the luxury goods category this year. Luxury watches are set to take a huge slice of that revenue—customers will spend $9.3 billion on them in 2025.

Despite pandemic-related recessions, this growth mirrors other financial crises. McKinsey predicted that consumers will “return more quickly to paying full price for quality, timeless goods, as was the case after the 2008 and 2009 financial crisis.”

Increasing affluence in Asia-Pacific and in the Middle East drove up the average revenue per luxury good consumer to $313. Despite luxury goods sales seeing sluggish growth at 3.4% annually, McKinsey forecasts indicate that ecommerce could triple in sales over the next decade—reaching $79.5 billion by 2025.

The biggest threat is the affordable luxury market. Should the industry offer luxury goods at multiple price points to grow the market overall? Or will affordable luxury dilute or erode the high-end luxury market—dampening consumer confidence that what they are buying is “true luxury”?

Inspirational fashion ecommerce businesses

Before we wrap up, take a quick look at a few big-name brands in the fashion industry seeing big wins with ecommerce.

Kotn

Kotn has sustainability at an affordable price point as their core principle, and they’ve more than exceeded that in their near decade as a fashion ecommerce retailer. The Toronto-founded brand gives back to the community that gives them their product materials: Egypt. The company continues working to build schools in the country (18 at this time), in turn impacting over 100,000 lives in the region for work and education.

SKIMS

There’s no fashion ecommerce brand quite like Kim Kardashian’s SKIMS. Kardashian’s brand is the pinnacle of social media and fashion converging. In 2023 alone, the business leader and influencer managed to take her DTC fashion brand to new heights, which included an expanded men’s line and a partnership with the National Basketball Association (NBA) and Swarovski.

SKIMS has set the tone for affordable shapewear, loungewear, pajamas, and lingerie, among other products, by using social media the most effectively for marketing and shopping, and pop-up retail spots. SKIMS shows their products on different body types, too.

Aimé Leon Dore

Streetwear and cult fashion brands come and go, and today’s offering is Aimé Leon Dore. The New York based brand has a broad appeal to all types of buyers who want to get in on the hype. The simplicity of the design, collaborations with New Balance and Porsche, and celebrity co-signs create ideal conditions for this fashion brand—once based in Queens, New York—to make it big online in a world where aesthetics are king.

Seize the fashion opportunity with Shopify

As the fashion industry continues to grow, you’ll need an ecommerce platform you can trust. A tool that will be there for you through the highs and lows of business—and never let you down.

That’s where we come in.

Whether you’re looking to boost conversions and lower costs or build a presence anywhere from retail to online to wholesale—or anything in-between—we’ve got you covered. And because we build with the future in mind, you’ll never have to worry about outgrowing your platform ever again.

Fashion Ecommerce FAQ

What is fashion ecommerce?

Fashion ecommerce is the selling and buying of fashion and apparel online. The fashion ecommerce industry is a highly competitive space where stores will try various marketing methods to stand out.

How big is the fashion ecommerce market?

According to Statista, the ecommerce fashion market is estimated to be US$752.5 billion in 2020. The market is expected to grow by 9.1% each year.

Is fashion ecommerce the largest ecommerce market segment?

Yes, fashion ecommerce is the largest B2C ecommerce market.

لا تعليق